- Call for Consultation: 212-843-4059 Tap Here to Call Us

The Irrevocable Life Insurance Trust And Crummey Powers

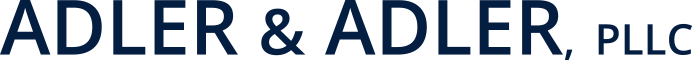

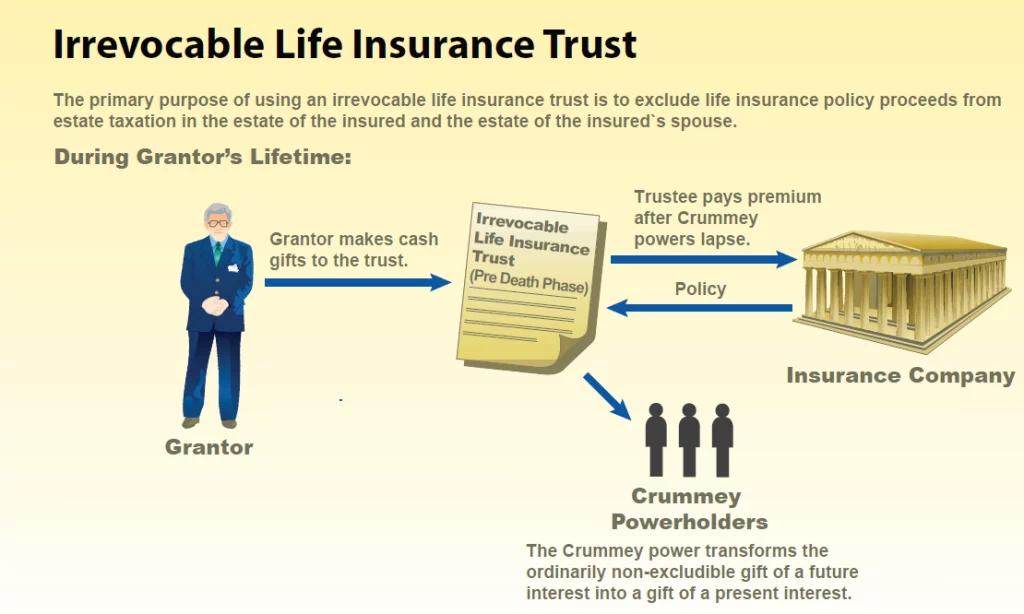

The primary purpose of using an irrevocable life insurance trust is to exclude the life insurance policy proceeds from estate taxation in the estate of the insured and the insured’s spouse. This can be accomplished even though the surviving spouse derives certain benefits from the trust while living. (The trust must be irrevocable, since property of a revocable trust is included in the grantor’s estate.) In the usual case, an unfunded irrevocable life insurance trust will rely on gifts from the trust grantor to provide the funds necessary to pay future premiums. Such gifts are subject to the gift tax. However there is a gift tax annual exclusion of up to $15,000 (as indexed) per donee per year for gifts of present interests. Gifts of a “future interest” do not qualify for the gift tax annual exclusion. Consequently, a gift of a policy in trust or subsequent gifts in trust of cash to pay future premiums would ordinarily be future interest gifts for which no annually excludable amount is available.

Preservation Of The Annual Exclusion Through Crummey Powers

Some years ago a clever tax planner drafted a trust provision which sought to convert the payment of insurance policy premiums by a trust grantor into a gift of a present interest which would qualify for the annual exclusion. The plan works essentially as follows. The grantor would make a gift of (assume $15,000) in cash to the trust. Upon receipt by the trust, each of the beneficiaries (assume three) would be given a right to withdraw one-third of the cash gift and pocket the money. If the power to withdraw were not exercised within a set period of time, the right would lapse. Assuming that none of the three power holders exercises his or her withdrawal right, the trustee would then be permitted by the trust instrument to use the money for the premium payment. By transferring the premium money to the trust, and giving each beneficiary at least a time-limited power to withdraw his or her designated portion, a present interest is created in each power holder to the extent of the amount which he or she may withdraw – in our example, $5,000.00 each. Thus, each of the three beneficiaries has received a present-interest gift which qualifies for the annual per-donee exclusion, each gift being less than $15,000 (as indexed). Assuming that none of the beneficiaries exercises his or her withdrawal right, the $15,000 premium will be paid by the trustee with no applicable gift tax! This technique has become an important tool in estate planning, particularly in connection with life insurance trusts. The time limited power of withdrawal granted in order to create present interests in the donees have come to be known as “Crummey powers.” One of the key provisions in an unfunded irrevocable life insurance trust is the “Crummey power.” By inserting a special trust provision creating a presently exercisable power of withdrawal, the otherwise non-excludable gift of a future interest is transformed into a gift of a present interest. In Crummey v. Commissioner, 397 F.2d 82 (9th Cir. 1968), the Ninth Circuit Court of Appeals held that an unrestricted right to the immediate use, possession and enjoyment of an addition to a trust, whether or not exercised (and whether or not likely to be exercised), makes the transfer a present interest for gift tax annual exclusion purposes.

In a subsequent revenue ruling, the IRS held that, a Crummey power holder must have knowledge of his demand rights under a Crummey power and must have a reasonable opportunity to exercise the power before it lapses, otherwise, the grantor will be denied the gift tax annual exclusion. Thirty (30) days seems to be the shortest reasonable period of time between notice of the withdrawal right and lapse. Notice should contain a detailed account of the existence and duration of the power and the conditions under which it can be exercised.

See also: Life Insurance and the Three Year Rule

Robert Adler, Esq. is a wills, trusts and estates attorney. He can be reached at 212-843-4059 or 646-946-8327.